Diamonds are supposed to be a girl’s best friend. However, we may be witnessing a BFF break-up. Diamond prices have continued to fall this year despite being regarded as among the rarest and most precious of jewels. Below is a price chart from the Zimnisky Global Rough Diamond Price Index showing falls from all time highs of -26%. Analysts expect prices will continue to fall further.

3 reasons for this fall are below, which may reveal some of the changing dynamics in the diamond and jewelry market.

Lab-grown diamonds are becoming more popular: The process for making diamonds in a laboratory involves extreme pressure and heat, copying how natural diamonds are created. Lab-grown diamonds are almost identical to natural diamonds in look and properties. As such, they are regarded as a perfect substitute with the important advantage of also being much cheaper. For socially conscious consumers, lab-grown diamonds also don’t involve the mining of conflict diamonds. “The share of lab grown diamond sales versus natural diamonds is rising. In 2020, they were just 2.4%. In 2023 to date they are already up to 9.3%,” said Edahn Golan, the CEO of Edahn Golan Diamond Research & Data.

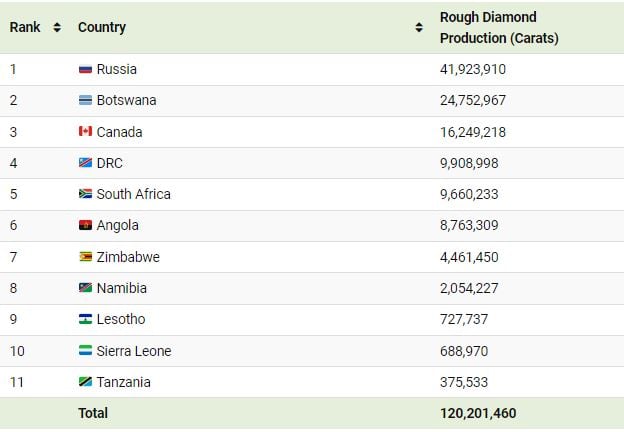

Ineffectual Sanctions: Russia is the world’s largest diamond producer. Below is a table from the Visual Capitalist highlighting the countries responsible for 99% of diamond production. In May, the G7 imposed sanctions on Russian diamonds, with the United Kingdom sanctioning Russia’s state-owned company Alrosa. However, analysts do not expect this to impact sales significantly. In fact, according to market analyst Paul Zimnisky, “the Russians have ramped up diamond sales in recent months in an attempt to claw back market share lost last year following the disruption in trading.” Countries like India and the UAE do not have sanctions on rough diamond imports. India is the world’s top diamond importer, with the U.S. coming in second, followed by Hong Kong, Belgium and the UAE.

Shifts In Consumer Spending: The market for diamonds is regarded as mostly consumer-driven, with sales relying on retail customers and the impact of advertising. This year, consumers have chosen to spend more on experiences, travelling and food than jewelry. In addition, economic slowdowns have started to affect the sales of luxury goods. Sales during the upcoming winter and valentines day seasons will be key indicators as these seasons are considered peak for engagements and jewelry purchases. Analysts expect there will be a slight increase in sales but perhaps not to levels seen during the pandemic.

Use Capnote’s industries function to track year on year growth in the Jewelry industries, find industry leaders and compare their operating or valuation metrics.

Written by Ikenna Ene